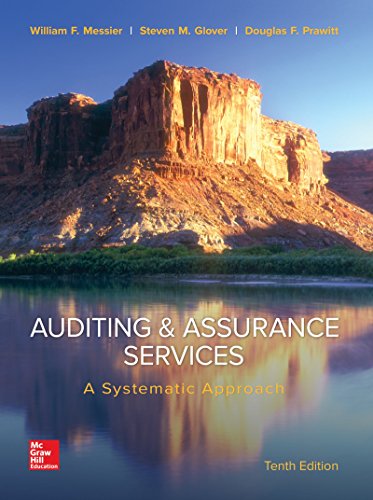

Auditing and Assurance Services A Systematic Approach 10th Edition by William Messier 1264468962 9781264468966

$50.00 Original price was: $50.00.$25.00Current price is: $25.00.

Auditing & Assurance Services: A Systematic Approach 10th Edition by William Messier Jr – Ebook PDF Instant Download/DeliveryISBN: 1264468962 9781264468966

Full download Auditing & Assurance Services: A Systematic Approach 10th Edition after payment.

Product details:

ISBN-10 : 1264468962

ISBN-13 : 9781264468966

Author : William Messier Jr

Auditing & Assurance Services: A Systematic Approach 10th Table of contents:

PART 1: Introduction to Assurance and Financial Statement Auditing

Chapter 1: An Introduction to Assurance and Financial Statement Auditing

Tips for Learning Auditing (and How Learning It Will Benefit You!)

The Demand for Auditing and Assurance

Principals and Agents

The Role of Auditing

An Assurance Analogy: The Case of the House Inspector

Seller Assertions, Information Asymmetry, and Inspector Characteristics

Desired Characteristics of the House Inspection Service

Relating the House Inspection Analogy to Financial Statement Auditing

Management Assertions and Financial Statements

Auditing, Attest, and Assurance Services Defined

Fundamental Concepts in Conducting a Financial Statement Audit

Materiality

Audit Risk

Audit Evidence Regarding Management Assertions

Sampling: Inferences Based on Limited Observations

The Audit Process

Overview of the Financial Statement Auditing Process

Major Phases of the Audit

The Unqualified/Unmodified Audit Report

Other Types of Audit Reports

Audit Data Analytics

Audit Data Analytics (ADA)

Financial Technologies

Technology and Professional Judgment

Conclusion

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Discussion Case

Internet Assignment

Hands-On Cases

IDEA and Tableau

Chapter 2: The Financial Statement Auditing Environment

Types of Auditors

External Auditors

Internal Auditors

Government Auditors

Fraud Auditors

Types of Other Audit, Attest, and Assurance Services

Other Audit Services

Attest Services

Assurance Services

Other Non-audit/Non-assurance Services

Public Accounting Firms

Organization and Composition

Two Decades of Challenge and Change for Financial Statement Auditors

Government Regulation

Society’s Expectations and the Auditor’s Responsibilities

The Context of Financial Statement Auditing

The Business Entity as the Primary Context of Auditing

A Model of Business

Corporate Governance

Objectives, Strategies, Processes, Controls, Transactions, and Reports

A Model of Business Processes: Five Components

Organizations That Affect the Public Accounting Profession

Securities and Exchange Commission (SEC)

Public Company Accounting Oversight Board (PCAOB)

American Institute of Certified Public Accountants (AICPA)

International Auditing and Assurance Standards Board (IAASB)

Financial Accounting Standards Board (FASB)

International Accounting Standards Board (IASB)

Auditing Standards

Three Sets of Auditing Standards: The Roles of the ASB, PCAOB, and IAASB

Principles Underlying an Audit Conducted in Accordance with Generally Accepted Auditing Standards

The Nature of Auditing Standards and the Codification of Standards

Ethics, Independence, and the Code of Professional Conduct

Conclusion

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Discussion Cases

Internet Assignments

Hands-On Cases

IDEA and Tableau

PART 2: Audit Planning and Basic Auditing Concepts

Chapter 3: Audit Planning, Types of Audit Tests, and Materiality

Client Acceptance and Continuance

Prospective Client Acceptance

Client Continuance

Preliminary Engagement Activities

Determine the Audit Engagement Team Requirements

Assess Compliance with Ethical and Independence Requirements

Establish an Understanding with the Entity

Planning the Audit

Audit Strategy and Plan

Assess Business Risks

Establish Materiality

Consider Multilocations or Business Units

Assess the Need for Specialists

Consider Violations of Laws and Regulations

Identify Related Parties

Consider Additional Value-Added Services

Document the Overall Audit Strategy, Audit Plan, and Prepare Audit Programs

Supervision of the Audit

Types of Audit Procedures

Risk Assessment Procedures

Tests of Controls

Substantive Procedures

Dual-Purpose Tests

Audit Data Analytics

Materiality

Steps in Applying Materiality

An Example

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Discussion Case

Internet Assignments

Hands-On Cases

IDEA

Chapter 4: Risk Assessment

Audit Risk

The Audit Risk Model

Use of the Audit Risk Model

The Auditor’s Risk Assessment Process

Management’s Strategies, Objectives, and Business Risks

Auditor’s Risk Assessment Procedures

Assessing Business Risks

Evaluate the Entity’s Risk Assessment Process

Assessing the Risk of Material Misstatement

Causes and Types of Misstatements

The Fraud Risk Assessment Process

The Auditor’s Response to the Results of the Risk Assessments

Evaluation of Audit Test Results

Documentation of the Auditor’s Risk Assessment and Response

Communications about Fraud to Management, the Audit Committee, and Others

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Discussion Case

Internet Assignment

Hands-On Cases

IDEA and Tableau

Chapter 5: Evidence and Documentation

The Relationship of Audit Evidence to the Audit Report

Management Assertions

Assertions about Classes of Transactions and Events, and Related Disclosures, for the Period under Audit

Assertions about Account Balances, and Related Disclosures, at the Period End

Understanding Audit Evidence

Information Used as Audit Evidence

The Sufficiency and Appropriateness of Audit Evidence

The Evaluation of Audit Evidence

Audit Procedures for Obtaining Audit Evidence

Inspection

Observation

Inquiry

Confirmation

Recalculation

Reperformance

Analytical Procedures

Reliability of Evidence

The Audit Testing Hierarchy

An “Assurance Bucket” Analogy

Audit Documentation

Purposes of Audit Documentation

Content of Audit Documentation

Examples of Audit Documentation

Format of Audit Documentation

Organization of Audit Documentation

Ownership of Audit Documentation

Audit Document Archiving and Retention

Advanced Module: Analytical Procedures

Auditor Decision Process-Analytical Procedures

Risk Assessment Analytical Procedures

Substantive Analytical Procedures

Final Analytical Procedures

Types of Analytical Procedures

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Discussion Cases

Internet Assignment

Hands-On Cases

IDEA and Tableau

PART 3: Understanding and Auditing Internal Control

Chapter 6: Internal Control in a Financial Statement Audit

Introduction

Internal Control—an Overview

Definition of Internal Control

Controls Relevant to the Audit

The Effect of Information Technology on Internal Control

The COSO Framework

Components of Internal Control

Control Environment

The Entity’s Risk Assessment Process

Control Activities

Information and Communication

Monitoring of Controls

Planning an Audit Strategy

Substantive Strategy

Reliance Strategy

Obtain an Understanding of Internal Control

Overview

Understanding the Control Environment

Understanding the Entity’s Risk Assessment Process

Understanding Control Activities

Understanding the Information System and Communications

Understanding Monitoring of Controls

Documenting the Understanding of Internal Control

The Effect of Entity Size on Internal Control

The Limitations of an Entity’s Internal Control

Assessing Control Risk

Identifying Specific Controls That Will Be Relied Upon

Performing Tests of Controls

Concluding on the Achieved Level of Control Risk

Documenting the Achieved Level of Control Risk

An Example

Substantive Procedures

Timing of Audit Procedures

Interim Tests of Controls

Interim Substantive Procedures

Auditing Accounting Applications Processed by Service Organizations

Communication of Internal Control–Related Matters

Advanced Module 1: Types of Controls in an IT Environment

General Controls

Application Controls

Advanced Module 2: Flowcharting Techniques

Symbols

Organization and Flow

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Discussion Cases

Hands-On Cases

IDEA

Chapter 7: Auditing Internal Control over Financial Reporting

Management Responsibilities under Section 404

Auditor Responsibilities under Section 404 and AS 2201

Internal Control over Financial Reporting Defined

Internal Control Deficiencies Defined

Control Deficiency

Material Weakness

Significant Deficiency

Likelihood and Magnitude

Management’s Assessment Process

Identify Financial Reporting Risks and Related Controls

Consider Which Locations to Include in the Evaluation

Evaluate Evidence about the Operating Effectiveness of ICFR

Reporting Considerations

Management’s Documentation

Performing an Audit of ICFR

Plan the Audit of ICFR

The Role of Risk Assessment and the Risk of Fraud

Scaling the Audit

Using the Work of Others

Identify Controls to Test

Identify Entity-Level Controls

Identifying Significant Accounts and Disclosures and Their Relevant Assertions

Understanding Likely Sources of Misstatements

Select Controls to Test

Evaluate the Design and Test the Operating Effectiveness of Controls

Evaluating Design Effectiveness of Controls

Testing and Evaluating Operating Effectiveness of Controls

Evaluating Identified Control Deficiencies

Examples of Control Deficiency Evaluation

Remediation of a Material Weakness

Written Representations

Auditor Documentation Requirements

Auditor Reporting on ICFR

Elements of the Auditor’s Report

Unqualified Opinion

Adverse Opinion for a Material Weakness

Disclaimer for Scope Limitation

Other Reporting Issues

Management’s Report Incomplete or Improperly Presented

The Auditor Decides to Refer to the Report of Other Auditors

Subsequent Events

Management’s Report Contains Additional Information

Reporting on a Remediated Material Weakness at an Interim Date

Additional Required Communications in an Audit of ICFR

Advanced Module 1: Special Considerations for an Audit of Internal Controls

Use of Service Organizations

Safeguarding of Assets

Advanced Module 2: Using Technology in the Audit of ICFR

Generalized Audit Software

Custom Audit Software

Test Data

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Internet Assignments

Hands-On Cases

Tableau

PART 4: Statistical and Nonstatistical Sampling Tools for Auditing

Chapter 8: Audit Sampling: An Overview and Application to Tests of Controls

Overview of Audit Sampling

Definitions and Key Concepts

Audit Sampling

Sampling Risk

Confidence Level

Tolerable and Expected Error

Audit Evidence Choices That Do and Do Not Involve Sampling

Types of Audit Sampling

Nonstatistical versus Statistical Sampling

Types of Statistical Sampling Techniques

Attribute Sampling Applied to Tests of Controls

Planning

Performance

Evaluation

Nonstatistical Sampling for Tests of Controls

Determining the Sample Size

Selecting the Sample Items

Calculating the Computed Upper Deviation Rate

Conclusion

Advanced Module 1: Considering the Effect on Sample Size of a Small Population

Advanced Module 2: Comparing Terminology for Attribute Sampling between IDEA and Sampling Tables

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Discussion Case

Hands-On Cases

IDEA

Chapter 9: Audit Sampling: An Application to Substantive Tests of Account Balances

Sampling for Substantive Tests of Details of Account Balances

Monetary-Unit Sampling

Advantages

Disadvantages

Applying Monetary-Unit Sampling

Planning

Performance

Evaluation

Nonstatistical Sampling for Tests of Account Balances

Identifying Individually Significant Items

Determining the Sample Size

Selecting Sample Items

Calculating the Sample Results

An Example of Nonstatistical Sampling

Advanced Module 1: Classic Variables Sampling

Advantages

Disadvantages

Applying Classical Variables Sampling

Advanced Module 2: Comparing Terminology for Monetary-Unit Sampling between IDEA and Manual Calculation

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Discussion Cases

Hands-On Cases

IDEA

PART 5: Auditing Business Processes

Chapter 10: Auditing the Revenue Process

Revenue Recognition

Overview of the Revenue Process

Types of Transactions and Financial Statement Accounts Affected

Types of Documents and Records

The Major Functions

Key Segregation of Duties

Inherent Risk Assessment

Industry-Related Factors

The Complexity and Contentiousness of Revenue Recognition Issues

The Difficulty of Auditing Transactions and Account Balances

Misstatements Detected in Prior Audits

Control Risk Assessment

Understand and Document Internal Control

Plan and Perform Tests of Controls

Set and Document Control Risk

Control Activities and Tests of Controls—Revenue Transactions

Occurrence of Revenue Transactions

Completeness of Revenue Transactions

Authorization of Revenue Transactions

Accuracy of Revenue Transactions

Cutoff of Revenue Transactions

Classification of Revenue Transactions

Presentation of Revenue Transactions and Events

Control Activities and Tests of Controls—Cash Receipts Transactions

Occurrence of Cash Receipts Transactions

Completeness of Cash Receipts Transactions

Authorization of Cash Discounts

Accuracy of Cash Receipts Transactions

Cutoff of Cash Receipts Transactions

Classification of Cash Receipts

Control Activities and Tests of Controls—Sales Returns and Allowances Transactions

Relating the Assessed Level of Control Risk to Substantive Procedures

Auditing Revenue-Related Accounts

Substantive Analytical Procedures

Tests of Details of Classes of Transactions, Account Balances, and Disclosures

Completeness

Cutoff

Existence

Rights and Obligations

Accuracy, Valuation, and Allocation

Classification

Presentation

The Confirmation Process—Accounts Receivable

Types of Confirmations

Timing

Confirmation Procedures

Alternative Procedures

Auditing Other Receivables

Evaluating the Audit Findings—Revenue-Related Accounts

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Discussion Cases

Internet Assignments

Hands-On Cases

IDEA and Tableau

Chapter 11: Auditing the Purchasing Process

Expense and Liability Recognition

Overview of the Purchasing Process

Types of Transactions and Financial Statement Accounts Affected

Types of Documents and Records

The Major Functions

The Key Segregation of Duties

Inherent Risk Assessment

Industry-Related Factors

Misstatements Detected in Prior Audits

Control Risk Assessment

Understand and Document Internal Control

Plan and Perform Tests of Controls

Set and Document Control Risk

Control Activities and Tests of Controls—Purchase Transactions

Occurrence of Purchase Transactions

Completeness of Purchase Transactions

Authorization of Purchase Transactions

Accuracy of Purchase Transactions

Cutoff of Purchase Transactions

Classification of Purchase Transactions

Presentation of Purchase Transactions

Control Activities and Tests of Controls—Cash Disbursement Transactions

Occurrence of Cash Disbursement Transactions

Completeness of Cash Disbursement Transactions

Authorization of Cash Disbursement Transactions

Accuracy of Cash Disbursement Transactions

Cutoff of Cash Disbursement Transactions

Classification of Cash Disbursement Transactions

Control Activities and Tests of Controls—Purchase Return Transactions

Relating the Assessed Level of Control Risk to Substantive Procedures

Auditing Accounts Payable and Accrued Expenses

Substantive Analytical Procedures

Tests of Details of Classes of Transactions, Account Balances, and Disclosures

Completeness

Existence

Cutoff

Rights and Obligations

Accuracy, Valuation, and Allocation

Classification

Presentation

Accounts Payable Confirmations

Evaluating the Audit Findings—Accounts Payable and Related

Advanced Module: Auditing the Tax Provision and Related Balance Sheet Accounts

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Discussion Case

Internet Assignments

Hands-On Cases

IDEA and Tableau

Chapter 12: Auditing the Human Resource Management Process

Overview of the Human Resource Management Process

Types of Transactions and Financial Statement Accounts Affected

Types of Documents and Records

The Major Functions

The Key Segregation of Duties

Inherent Risk Assessment

Control Risk Assessment

Understand and Document Internal Control

Plan and Perform Tests of Controls

Set and Document the Control Risk

Control Activities and Tests of Controls—Payroll Transactions

Occurrence of Payroll Transactions

Authorization of Payroll Transactions

Accuracy of Payroll Transactions

Classification of Payroll Transactions

Presentation of Payroll Transactions and Compensation Data

Relating the Assessed Level of Control Risk to Substantive Procedures

Auditing Payroll-Related Accounts

Substantive Analytical Procedures

Tests of Details of Classes of Transactions, Account Balances, and Disclosures

Payroll Expense Accounts

Accrued Payroll Liabilities

Evaluating the Audit Findings—Payroll-Related Accounts

Advanced Module: Share-Based Compensation

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Discussion Cases

Internet Assignment

Hands-On Cases

IDEA and Tableau

Chapter 13: Auditing the Inventory Management Process

Overview of the Inventory Management Process

Types of Documents and Records

The Major Functions

The Key Segregation of Duties

Inherent Risk Assessment

Industry-Related Factors

Engagement and Operating Characteristics

Control Risk Assessment

Understand and Document Internal Control

Plan and Perform Tests of Controls

Set and Document the Control Risk

Control Activities and Tests of Controls—Inventory Transactions

Occurrence of Inventory Transactions

Completeness of Inventory Transactions

Authorization of Inventory Transactions

Accuracy of Inventory Transactions

Cutoff of Inventory Transactions

Classification of Inventory Transactions

Presentation of Inventory

Relating the Assessed Level of Control Risk to Substantive Procedures

Auditing Inventory

Substantive Analytical Procedures

Auditing Standard Costs

Materials

Labor

Overhead

Observing Physical Inventory

Tests of Details of Classes of Transactions, Account Balances, and Disclosures

Accuracy

Cutoff

Existence

Completeness

Rights and Obligations

Valuation, Accuracy, and Allocation

Classification and Presentation

Evaluating the Audit Findings—Inventory

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Discussion Case

Internet Assignment

Hands-On Cases

IDEA and Tableau

Chapter 14: Auditing the Financing/Investing Process: Prepaid Expenses, Intangible Assets, and Property, Plant, and Equipment

Auditing Prepaid Expenses

Inherent Risk Assessment—Prepaid Expenses

Control Risk Assessment—Prepaid Expenses

Substantive Procedures—Prepaid Insurance

Substantive Analytical Procedures for Prepaid Insurance

Tests of Details of the Prepaid Insurance

Existence and Completeness

Rights and Obligations

Valuation

Classification

Auditing Intangible Assets

Inherent Risk Assessment—Intangible Assets

Control Risk Assessment—Intangible Assets

Substantive Procedures—Intangible Assets

Substantive Analytical Procedures for Intangible Assets

Tests of Details of Intangible Assets

Auditing the Property Management Process

Types of Transactions

Overview of the Property Management Process

Inherent Risk Assessment—Property Management Process

Complex Accounting Issues

Difficult-to-Audit Transactions

Misstatements Detected in Prior Audits

Control Risk Assessment—Property Management Process

Occurrence and Authorization

Completeness

Segregation of Duties

Substantive Procedures—Property, Plant, and Equipment

Substantive Analytical Procedures—Property, Plant, and Equipment

Tests of Details of Transactions, Account Balances, and Disclosures—Property, Plant, and Equipment

Evaluating the Audit Findings—Property, Plant, and Equipment

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Discussion Case

Internet Assignments

Hands-On Cases

IDEA and Tableau

Chapter 15: Auditing the Financing/Investing Process: Long-Term Liabilities, Stockholders’ Equity, and Income Statement Accounts

Auditing Long-Term Debt

Inherent Risk Assessment—Long-Term Debt

Control Risk Assessment—Long-Term Debt

Assertions and Related Control Activities

EarthWear Substantive Procedures—Long-Term Debt

Auditing Stockholders’ Equity

Control Risk Assessment—Stockholders’ Equity

Assertions and Related Control Activities

Segregation of Duties

Auditing Capital-Stock Accounts

Occurrence and Completeness

Valuation

Completeness of Disclosures

Auditing Dividends

Auditing Retained Earnings

Auditing Income Statement Accounts

Assessing Control Risk for Business Processes—Income Statement Accounts

Substantive Procedures—Income Statement Accounts

Direct Tests of Balance Sheet Accounts

Substantive Analytical Procedures for Income Statement Accounts

Tests of Selected Account Balances

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Discussion Case

Internet Assignment

Hands-On Cases

IDEA and Tableau

Chapter 16: Auditing the Financing/Investing Process: Cash and Investments

Auditing Cash

Types of Bank Accounts

General Cash Account

Imprest Cash Accounts

Branch Accounts

Control Risk Assessment—Cash

Substantive Procedures—Cash

Substantive Analytical Procedures—Cash

Substantive Tests of Details of Transactions and Balances—Cash

Auditing the General Cash Account

Fraud-Related Audit Procedures

Auditing a Payroll or Branch Imprest Account

Auditing a Petty Cash Fund

Disclosure Issues for Cash

Auditing Investments

Control Risk Assessment—Investments

Assertions and Related Control Activities

Segregation of Duties

Substantive Procedures—Investments

Substantive Analytical Procedures—Investments

Tests of Details—Investments

Advanced Module: Auditing Fair Value Measurements

Understanding How Management Makes Fair Value Measurements

Considering Whether Specialized Skills or Knowledge Is Required

Testing the Entity’s Fair Value Measurements

Evaluating the Reasonableness of the Fair Value Measurements

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Internet Assignment

Hands-On Case

IDEA and Tableau

PART 6: Completing the Audit and Reporting Responsibilities

Chapter 17: Completing the Audit Engagement

Review for Contingent Liabilities

Audit Procedures for Identifying Contingent Liabilities

Letters of Audit Inquiry

Commitments

Review of Subsequent Events for Audit of Financial Statements

Dual Dating

Audit Procedures for Subsequent Events

Review of Subsequent Events for the Audit of Internal Control over Financial Reporting

Final Steps and Evidence Evaluation

Final Analytical Procedures

Management Representation Letter

Audit Work Paper Review

Evaluation of Audit Results

Evaluating Financial Statement Presentation and Disclosure

Engagement Quality Review

Archiving and Retention

Going-Concern Considerations

Communications with Those Charged with Governance and Management

Communications Regarding the Audit of Internal Control over Financial Reporting

Management Letter

Subsequent Discovery of Facts Existing at the Date of the Auditor’s Report

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Discussion Cases

Internet Assignments

Hands-On Cases

IDEA and Tableau

Chapter 18: Reports on Audited Financial Statements

Reporting on the Financial Statement Audit: The Standard Unqualified/Unmodified Audit Report

The Standard Unqualified Audit Report for Public Companies

Critical Audit Matters: More Information and Insight in the Audit Report

The Standard Unmodified Audit Report for Entities Other Than Public Companies

Explanatory Language Added to the Standard Unqualified/Unmodified Financial Statement Audit Report

Explanatory Language to Refer to Reports of Other Auditors

Substantial Doubt about the Entity’s Ability to Continue as a Going Concern

Lack of Comparability of Financial Statements between Periods

Management Reports on ICFR but Audit of ICFR Not Required

Circumstances in Which the Auditor Wishes to Emphasize a Matter

Departures from an Unqualified/Unmodified Financial Statement Audit Report

Conditions for Departure

Types of Financial Statement Audit Opinions Other Than Unqualified/Unmodified

The Effect of Materiality on Financial Statement Reporting

Discussion of Conditions Requiring Other Types of Financial Statement Audit Reports

Scope Limitation

Statements Not in Conformity with GAAP

Auditor Not Independent

Special Reporting Issues

Reports on Comparative Financial Statements

Different Reports on Comparative Financial Statements

A Change in Report on the Prior-Period Financial Statements

Report by a Predecessor Auditor

Other Information in Documents Containing Audited Financial Statements

Special Reports Relating to Financial Statements

Financial Statements Prepared According to Other Comprehensive Bases of Accounting

Specified Elements, Accounts, or Items of a Financial Statement

Compliance Reports Related to Audited Financial Statements

The First Significant Change to the Auditor’s Report in More Than 70 Years

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Discussion Case

Hands-On Cases

IDEA

PART 7: Professional Responsibilities

Chapter 19: Professional Conduct, Independence, and Quality Management

Ethics and Professional Conduct

Ethics and Professionalism Defined

Theories of Ethical Behavior

Example—an Ethical Challenge

An Overview of Ethics and Professionalism in Public Accounting

A Tale of Two Companies

Standards for Auditor Professionalism

The AICPA Code of Professional Conduct: A Comprehensive Framework for Auditors

Principles of Professional Conduct

Rules of Conduct

Integrity, Objectivity, and Independence

Integrity and Objectivity—Framework, Rule, and Interpretations

Independence

Other Rules in the Code of Professional Conduct

General Standards and Accounting Principles

Confidential Information

Fees and Other Types of Remuneration

Acts Discreditable

Advertising and Other Forms of Solicitation

Form of Organization and Name

Disciplinary Actions

Don’t Lose Sight of the Forest for the Trees

Quality Management Standards

The New Quality Management Paradigm

Managing Quality on Audit and Attestation Engagements

PCAOB Inspections of Registered Public Accounting Firms

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Discussion Cases

Internet Assignment

Hands-On Cases

Chapter 20: Legal Liability

Introduction

Historical Perspective

Overview of Auditor Legal Liability

Common Law—Clients

Breach of Contract—Client Claims

Negligence—Client Claims

Fraud—Client Claims

Common Law—Third Parties

Ordinary Negligence—Third-Party Claims

Fraud and Gross Negligence—Third-Party Claims

Damages under Common Law

Statutory Law—Civil Liability

Securities Act of 1933

Securities Exchange Act of 1934

Private Securities Litigation Reform Act of 1995, the Securities Litigation Uniform Standards Act of 1998, and the Class Action Fairness Act of 2005

Sarbanes-Oxley Act of 2002

SEC and PCAOB Sanctions

Foreign Corrupt Practices Act

Racketeer Influenced and Corrupt Organizations Act

Statutory Law—Criminal Liability

Academic Research Regarding Audit-Related Litigation

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Discussion Cases

Hands-On Cases

IDEA

PART 8: Assurance, Attestation, and Internal Auditing Services

Chapter 21: Assurance, Attestation, and Internal Auditing Services

Assurance Services

Types of Assurance Services

Attestation Engagements

Types of Attestation Engagements

Financial Forecasts and Projections

Types of Prospective Financial Statements

Examination of Prospective Financial Statements

Agreed-Upon Procedures for Prospective Financial Statements

Accounting and Review Services

Preparation of Financial Statements

Compilation of Financial Statements

Review of Financial Statements

Internal Auditing

Internal Auditing Defined

The Institute of Internal Auditors

IIA Standards

Internal Auditors’ Roles

Interactions between Internal and External Auditors

Advanced Module: An Example of An Assurance Service—Trust Services

Trust Services

Trust Services and SOC 2®, SOC 3®, and SOC for Cybersecurity® Reports

Key Terms

Review Questions

Multiple-Choice Questions

Problems

Discussion Case

Internet Assignments

Hands-On Cases

People also search for Auditing & Assurance Services: A Systematic Approach 10th:

auditing & assurance services a systematic approach

auditing and assurance services a systematic approach twelfth edition

auditing and assurance services a systematic approach 9th ed

auditing and assurance services a systematic approach

auditing and assurance services a systematic approach 12th edition

Tags:

Auditing,Assurance Services,Systematic Approach,William Messier

You may also like…

Business & Economics - Accounting

Business & Economics - Accounting

AUDITING and ASSURANCE SERVICES 9th Edition by Timothy Louwers 1266847929 9781266847929

Business & Economics - Accounting

Uncategorized

Auditing & Assurance Services (Auditing and Assurance Services) 7th Edition, (Ebook PDF)

Medicine - Ophthalmology

Kanski’s Clinical Ophthalmology. A Systematic Approach 9th Edition

Medicine - Ophthalmology

Kanski’s clinical ophthalmology : a systematic approach 8th Edition Bradley Bowling

Business & Economics - Accounting

Biography & Autobiography - Business & Finance

Auditing: A Risk Based-Approach 11th Edition Johnstone-Zehms