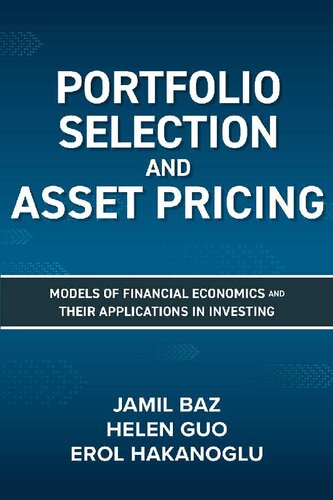

Portfolio Selection and Asset Pricing: Models of Financial Economics and Their Applications in Investing 1st Edition

$50.00 Original price was: $50.00.$25.00Current price is: $25.00.

Portfolio Selection and Asset Pricing: Models of Financial Economics and Their Applications in Investing 1st Edition – Ebook Instant Download/Delivery ISBN(s): 9781264270156,9781264270163,1264270151,126427016X

Product details:

- ISBN-10: 126427016X

- ISBN-13: 9781264270163

- Author: Jamil Baz; Helen Guo; Erol Hakanoglu

This uniquely comprehensive guide provides expert insights into everything from financial mathematics to the practical realities of asset allocation and pricing Investors like you typically have a choice to make when seeking guidance for portfolio selection―either a book of practical, hands-on approaches to your craft or an academic tome of theories and mathematical formulas. From three top experts, Portfolio Selection and Asset Pricing strikes the right balance with an extensive discussion of mathematical foundations of portfolio choice and asset pricing models, and the practice of asset allocation. This thorough guide is conveniently organized into four sections: Mathematical Foundations―normed vector spaces, optimization in discrete and continuous time, utility theory, and uncertainty Portfolio Models―single-period and continuous-time portfolio choice, analogies, asset allocation for a sovereign as an example, and liability-driven allocation Asset Pricing―capital asset pricing models, factor models, option pricing, and expected returns Robust Asset Allocation―robust estimation of optimization inputs, such as the Black-Litterman Model and shrinkage, and robust optimizers Whether you are a sophisticated investor or advanced graduate student, this high-level title combines rigorous mathematical theory with an emphasis on practical implementation techniques.

Table contents:

PART I Mathematical Foundations

1 Functional Analysis in Real Vector Spaces

2 Optimization in Discrete Time

3 Optimization in Continuous Time

4 Utility Theory

5 Uncertainty: Basics of Probability and Statistics

6 Uncertainty: Stochastic Processes and Calculus

PART II Portfolio Models

7 Single-Period and Continuous-Time Portfolio Choice

8 An Example of Asset Allocation for a Sovereign

9 Liability-Driven Asset Allocation

PART III Asset Pricing

10 Equilibrium Asset Pricing

11 Factor Models

12 Derivatives Pricing

13 Interest Rate Models

14 Risk Premia

PART IV Asset Allocation in Practice

15 Motivations for Robust Asset Allocation

16 Risk Budgeting Approach to Asset Allocation

17 Black–Litterman Model

18 Shrinkage

19 Robust Optimizers

People also search:

asset allocation portfolio examples

portfolio asset classes

portfolio fees for models

portfolio price

asset pricing and portfolio choice theory

asset pricing and portfolio choice theory pdf

You may also like…

Business & Economics

Business & Economics - Investing

Business & Economics - Personal Finance

Business & Economics

Business & Economics - Professional Finance

Foreign Exchange: Practical Asset Pricing and Macroeconomic Theory 1st ed. 2022 Edition Iqbal